STILL THE HOTTEST STOCK TO BUY

NVIDIA stocks hit record high as company hits $2 Trillion valuation.

Sign up for free and start investing today.

- Hottest Stocks

- Market Insiders

- 24/7 Support

- Big Returns

The release of Nvidia's (NVDA 4.00%) fourth-quarter fiscal 2024 results, covering the period ending January 28th, dispelled any uncertainties about the company's ability to maintain its remarkable momentum in the stock market.

The semiconductor giant not only exceeded Wall Street’s expectations significantly but also provided robust guidance for the current quarter, indicating a sustained trajectory of growth driven by artificial intelligence (AI).

Unsurprisingly, Nvidia’s stock experienced a substantial surge post-earnings release. Furthermore, analysts have initiated upward revisions to their growth projections for the current fiscal year and the following two years, underscoring the belief in the company’s enduring exceptional growth.

NVIDIA announces Project GR00T, a general-purpose foundation model for humanoid robots,

NVIDIA unveiled Project GR00T, a versatile foundation model for humanoid robots. This initiative aims to advance NVIDIA’s efforts in driving innovation in robotics and embodied AI.

The introduction of new foundation models by NVIDIA BioNeMo enhances the scope of computer-aided drug discovery.

Cadence OpenEye, Flagship Pioneering, and Iambic are among the companies integrating NVIDIA AI technology to advance computer-aided drug discovery and generative AI.

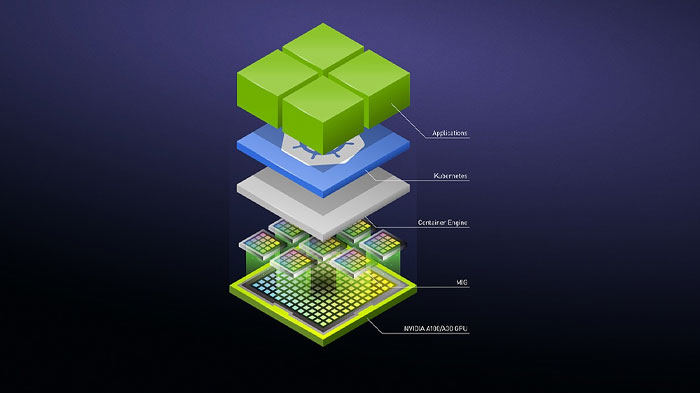

NVIDIA introduces cloud services to extend generative AI capabilities to enterprises worldwide.

AI disruption has the potential to uphold Nvidia's dominance in this highly profitable market.

Nvidia’s GPUs gained prominence for their crucial role in training large language models (LLMs) like ChatGPT. The company holds a dominant 90% share in the AI training chip market, with cloud service providers actively seeking its GPUs.

The strong demand for Nvidia’s flagship H100 AI GPU is evident, with customers willing to wait 36 to 52 weeks for this hardware. To meet this demand, Nvidia is expanding its supply capacity, anticipating substantial growth. Revenue is projected to more than double by fiscal 2027, compared to the $60.9 billion in fiscal 2024.

Kress’ mention that 40% of Nvidia’s data center revenue comes from AI inference chip sales suggests prolonged impressive growth. AI inference chips are anticipated to dominate the AI chip market, accounting for 45%, while AI training chips will represent 15%, according to TechSpot.

As AI inference chip demand surges from an estimated $16 billion in 2023 to nearly $91 billion in 2030, Nvidia, having sold $19 billion worth last year, appears to dominate this market. If the market reaches $90 billion, Nvidia’s data center revenue could continue thriving, driving overall business growth through the end of the decade.

The stock's valuation is a clear no-brainer to buy now

With Nvidia’s anticipated rapid growth in earnings and revenue over the coming years, investing in the stock seems like a straightforward choice.

If the company delivers on these expectations, the market is likely to reward Nvidia with substantial gains, making it an attractive proposition for investors right now.